Great Tips For Deciding On An RSI Divergence Strategy

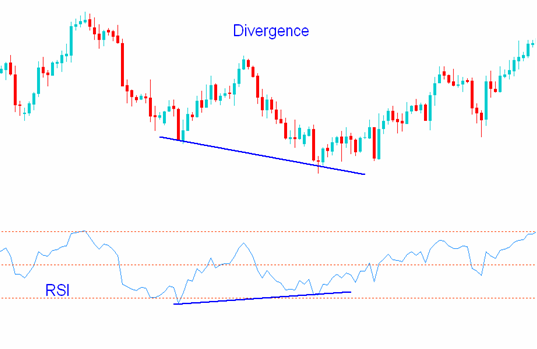

Let's begin with the obvious question. We will explore what RSI Divergence actually is and the trading information we can get from it. If the price action and RSI indicator is not in the same place on the chart, then there is the possibility of a divergence. In downtrend markets, the price action makes a lower low, and the RSI indicator is able to make lower lows. A divergence is essentially is when the indicator does not agree with the price action and when a situation like this occurs, you need to pay attention to the market. According to the chart, both the bullish RSI divergence and the bearish RSI divergence are clearly visible and the price movement actually reversed after both RSI divergence signals. Is that right? Let's get to one final topic before moving to the thrilling topic. Take a look at top forex tester for website examples including backtesting, automated crypto trading, forex backtesting, stop loss, forex backtest software, backtester, trading divergences, automated cryptocurrency trading, backtesting platform, stop loss and more.

How Do You Assess Rsi Diversgence?

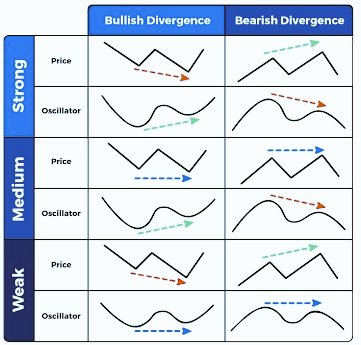

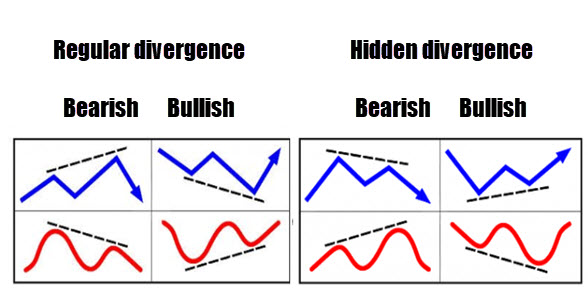

We employ RSI to detect trends that are reversing. Therefore, it is essential to recognize the most appropriate one.

How To Spot Rsi Divergence When Trading In Forex

At the start of the trend at the beginning of the uptrend, both RSI indicator and Price Action performed the same process by making higher highs. This suggests that the trend could be strong. The trend ended when Price reached higher highs towards the end. However, the RSI indicator was able to reach lower highs. This suggests that this chart is worth watching. Here is the reason we should pay close at the market. Both the indicator and the price action are out-of-synchrony, which signifies the presence of an RSI divergence. In this instance, the RSI divergence is a sign of a bearish trend change. Look at the chart and see what happened after the RSI split. The RSI divergence is extremely precise when used to detect trends that are reversing. The question ishow do you spot a trend reversal? Let's look at four strategies for trade entry which provide higher probability entry signals when combined with RSI divergence. Take a look at top forex backtesting for blog advice including automated crypto trading, forex tester, backtesting platform, best crypto trading platform, automated trading bot, RSI divergence, best trading platform, automated trading platform, crypto trading bot, automated forex trading and more.

Tip #1 – Combining RSI Divergence & Triangle Pattern

Two variants of the triangle chart pattern are available. The pattern of the ascending triangle can be used to reverse a downward trend. The pattern of the descending triangle acts as an uptrend market reversal pattern. Below is the downward triangle pattern. Similar to the previous example, market was in an upward trend , but the price started to fall. In the same way, RSI also signals the divergence. These signals point out the weaknesses of this trend. The current price shows that the speed of the ongoing upward trend has diminished and the price was capped in a triangular pattern that descending. This is also a confirmation of the reversal. Now it is time to take the short trade. The trade was completed by using the same breakout method as the previous one. We will now look at the third trade entry method. This time we'll pair trend structure with RSI diversion. We will now look at ways to trade RSI diversion in the event that the structure of the trend is changing. View the recommended backtesting platform for more advice including backtesting strategies, software for automated trading, trading platforms, trading platform crypto, RSI divergence cheat sheet, forex backtester, trading with divergence, forex backtester, backtesting trading strategies, forex backtesting and more.

Tip #2 – Combining RSI Divergence with the Head and Shoulders Pattern

RSI divergence aids forex traders in recognizing market reverses. Combining RSI diversification with other reversal indicators like the Head and shoulders patterns can increase our trade probability. That's fantastic! Let's examine how to timing trades using RSI divergence combined with the pattern of head and shoulders. Related - How To Trade Head and Shoulders Forex - A Reversal Trading Strategie. Before committing to trades, it is important that there is a favorable market. A market that is trending is preferred since we're trying discover an opportunity to reverse the trend. Look at this chart. Read the recommended forex trading for more examples including backtesting strategies, automated forex trading, trading platform cryptocurrency, trading platform cryptocurrency, best trading platform, backtesting, trading platforms, cryptocurrency trading bot, backtesting tool, software for automated trading and more.

Tip #3 – Combining RSI Divergence with the Trend Structure

The trend is our friend, isn't it? If the market is in a trend, then we should be trading in the direction of that trend. This is what experts teach. But, the trend is not going to last for ever. Somewhere it will reverse. Let's find out how to identify reversals fast by observing the trend structure as well as the RSI Divergence. You've probably noticed that the trend upward is creating higher highs while downtrend is creating lower bottoms. The chart below illustrates this point. The chart's left side shows a downtrend, with a series a highs and lows. Then, let's take another glance (Red Line) at the RSI divergence. The RSI produces higher lows, while price action causes them. What is this indicating? Although the market is creating lows, the RSI does the opposite thing this indicates ongoing downtrend is losing its momentum and we should prepare for a reverse. Check out the recommended crypto trading backtesting for blog advice including forex backtesting software free, trading with divergence, RSI divergence cheat sheet, crypto trading, automated cryptocurrency trading, forex tester, automated trading software, automated trading platform, automated trading, trading platforms and more.

Tip #4 – Combining Rsi Divergence, The Double Top Double Bottom, And Double Bottom

Double top or double bottom is a pattern of reversal which is created after an extended move or following a trend. Double tops are formed after the price has reached a point that cannot easily be broken. Once that level is reached it will then retrace slightly and then return to the level it was at. A DOUBLE TOP occurs when the price bounces off this mark. Below is a double top. The double top shows double top that both tops were created following a powerful move. You'll notice that the second top has not been able to break through the top of the previous. This is an obvious sign that a reverse is on the way since it indicates that buyers are having difficulty going higher. The same set of principals applies to the double bottom, however in a different way. We employ the technique of breakout entry to trade. In this scenario we make an order to sell when the price broke below the trigger line. Within one day, our take-profit reached. Quick Profit. Double bottom is also a requirement for the same techniques for trading. Have a look at the chart below which describe how you can trade RSI divergence in conjunction with double bottom.

This isn't the most ideal trading strategy. There is no "perfect" trading method. Every strategy for trading suffers from losses. While we earn consistent profits through this strategy, we also use tight risk management and a fast method to reduce the losses. It will help reduce the drawdown which can allow for huge upside potential.

Comments on “Great Tips For Picking An RSI Divergence Strategy”